12A and 80G Registration

12A and 80G Registration are approvals granted by the Income Tax Department of India to non-profit entities such as NGOs, Trusts, and Societies.

12A Registration exempts the income of these organizations from income tax, allowing them to utilize their resources fully for charitable or religious purposes without paying tax on surplus income.

advantages and disadvantages of Provisional 12A & 80G Registration for NGOs, Trusts, and Societies:

80G Registration provides tax benefits to donors; individuals or organizations making donations to an 80G-registered entity can claim deductions on the donated amount while filing their income tax returns.

Both registrations enhance credibility, attract more donations, and are often mandatory for availing government grants and CSR (Corporate Social Responsibility) funds.

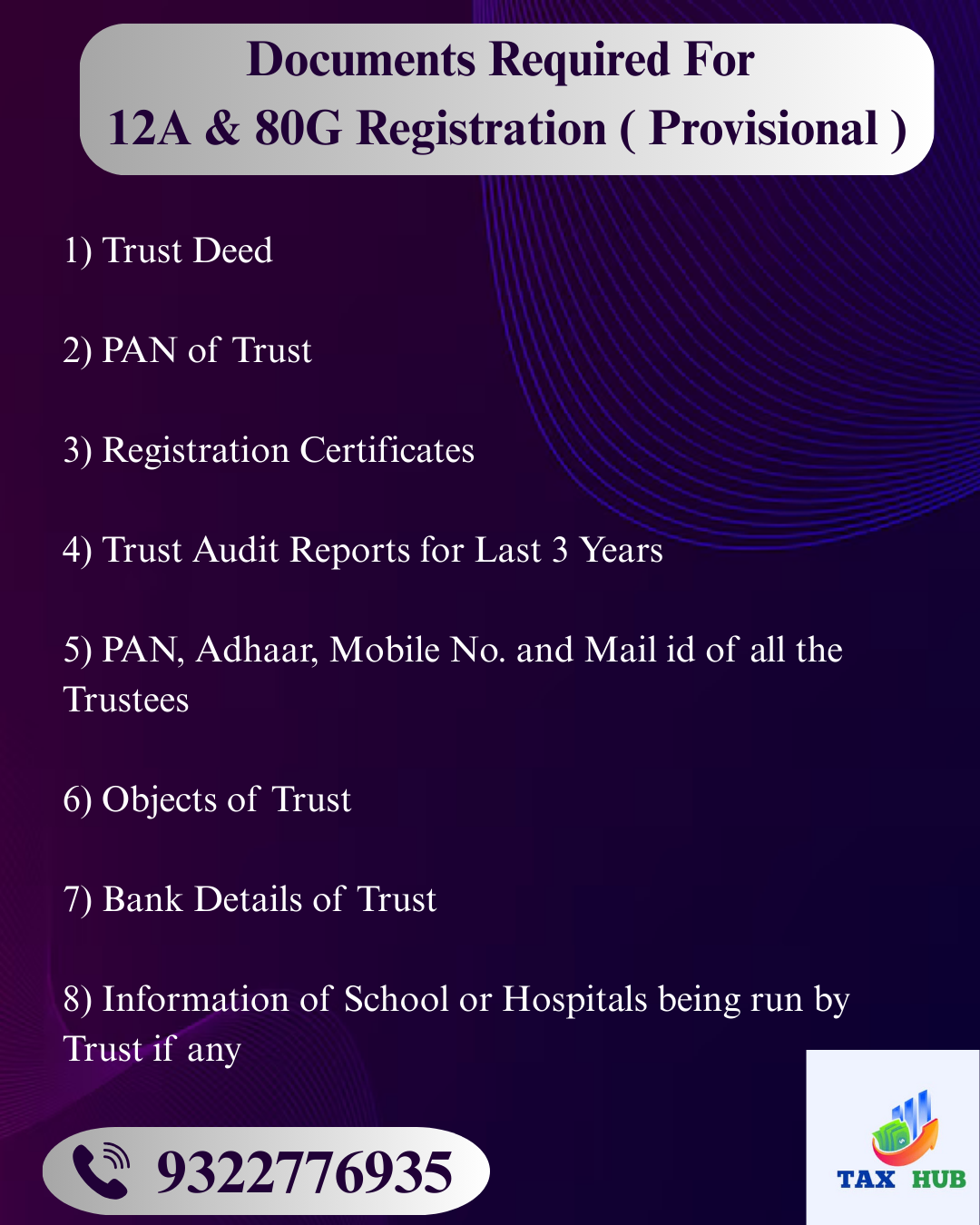

To obtain these, the organization must apply online with required documents like registration certificate, PAN, trust deed or memorandum, activity reports, audited accounts, and details of trustees or office bearers.

12A Registration (Provisional)

Advantages:

Income Tax Exemption

The NGO’s income is exempt from tax under sections 11 & 12 of the Income Tax Act.Donations, grants, and funds received can be fully utilized for charitable purposes without tax liability.

Eligibility for 80G Registration

Without 12A, an organization cannot apply for 80G. Provisional 12A helps in securing 80G approval.Boosts Credibility

Donors and funding agencies prefer giving to tax-exempt entities.Improves the organization’s reputation and trustworthiness.

Eligibility for Government/CSR Grants

Many government schemes, CSR (Corporate Social Responsibility) contributions, and foreign funding (via FCRA) require 12A registration.Initial Flexibility (Provisional)

Even if the NGO is newly established, it can apply and get provisional 12A for 3 years, which allows it to function and start collecting donations legally.Disadvantages:

Compliance Burden

The NGO must maintain proper books of accounts, audits, and annual returns (Form 10B, ITR-7).Non-compliance can lead to cancellation.

Restricted Utilization of Funds

Income must be applied for charitable purposes only. Misuse leads to penalties or cancellation.At least 85% of income must be applied towards objects of the trust annually.

Provisional Nature

Valid for 3 years only. For permanent registration, NGO must re-apply with proof of activities.If unable to show genuine activities, permanent approval may be rejected.

Scrutiny by IT Department

Activities and accounts are closely monitored by the Income Tax Department, creating administrative pressure.80G Registration (Provisional)

Advantages:

Tax Benefit to Donors

Donors get 50% deduction on donations made to an 80G-registered NGO.Encourages higher donations.

Attracts CSR Funding

Corporates prefer donating to 80G-approved NGOs, since it helps them in tax savings & CSR compliance.Donor Confidence & Credibility

Having 80G status improves transparency and reliability in the eyes of individuals and institutions.Provisional Benefit

Even a newly formed NGO with little activity can apply and obtain provisional 80G for 3 years.This allows it to collect donations immediately while building its track record.

Disadvantages:

Compliance Requirement

NGOs must file statements of donations in Form 10BD annually and issue donation certificates (Form 10BE) to donors.Failure attracts penalties.

Provisional Limitation

The registration is only valid for 3 years. To continue, NGOs must apply for permanent approval after showing genuine charitable activities.Stringent Monitoring

Income Tax Department checks utilization of donations, ensuring they are not misapplied for personal or non-charitable use.Misuse can lead to cancellation and penalties.

Donor Dependency

Since donors are often motivated by tax benefits, NGOs may become heavily dependent on 80G status for fundraising. If revoked, donations may reduce drastically.Summary Comparison

| Feature | 12A (Provisional) | 80G (Provisional) |

|---|---|---|

| Purpose | Income Tax exemption for NGO | Tax deduction benefit to donors |

| Validity | 3 years (provisional) | 3 years (provisional) |

| Beneficiary | NGO itself | Donors (individuals/corporates) |

| Key Advantage | No tax on NGO’s income | Attracts donations by offering tax benefit |

| Key Disadvantage | High compliance, must apply 85% funds | Extra reporting burden (10BD, 10BE) |

In short:

12A Provisional helps the NGO save tax and qualify for funding.

80G Provisional helps attract donors by giving them tax benefits.

Both are initially provisional for 3 years, after which the NGO must prove genuine charitable activities for permanent approval.